Leading forex and payment solutions provider Transcorp International Ltd, a 25 year old BSE-listed company, announced the receipt of RBI’s nod for entering into co-branding arrangements for Prepaid Instruments that can be used for transactions in over 35 lac stores and online gateways across the country. this can be used by organizations to disburse wages and salaries to all employees, including those that do not have a bank account.

Transcorp is proud to be the one of the first non-bank companiest to obtain this authorization from RBI, which a testament to its commitment of serving Indian citizens and companies alike. Transcorp has leveraged its PPI license to operate which is the same license held by leading mobile-wallet operators in India.

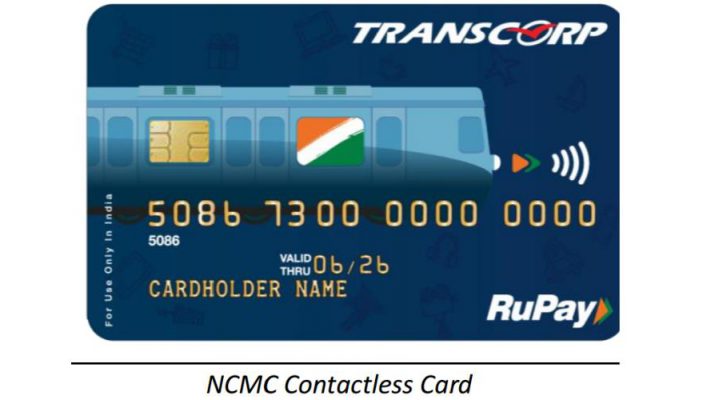

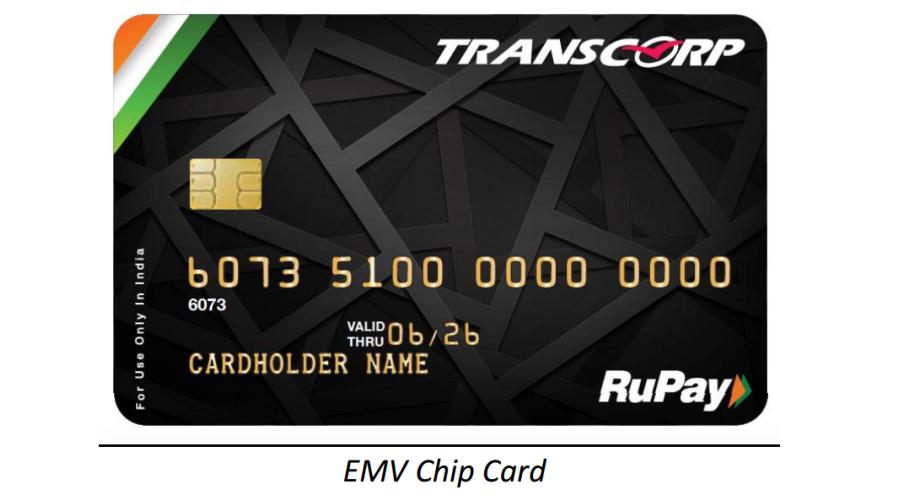

In line with the Government’s initiatives of cashless India and to promote safe transactions by eliminating the handling of currency, Transcorp has launched Multi-Wallet Prepaid cards which has become the gold standard for expenses, incentives and reimbursements across business houses. The card is powered in association with RUPAY – India’s very own switch powered by NPCI.

During the present COVID-19 crisis where it is not safe to handle cash, Prepaid Cards, including contactless, provide a safe mode of payment. The contactless variant of the card is also recommended globally by experts as a safer option to transact.

There are several variants of the card, some of which can be upgraded to higher limits by providing additional KYC details:

- Gift Cards: upto Rs. 10,000 (non-reloadable)

- Min KYC Cards: Upto Rs. 10,000 monthly (reloadable and issued via OTP)

- Full KYC Cards: Upto Rs. 100,000 at one time (reloadable and issued via full KYC)

“These cards can replace cash payment for all value transactions up to Rs. 1,00,000. Organizations that need to disburse payments like wages, reimbursements, incentives and other recurring payments to their employees or beneficiaries can seamlessly do so. This facilitates the accounting department to manage expenses by not having to check every individual bill; eliminating cash as a medium of paying for company expenses. Organizations have experienced cost reductions and transparency. ” said Mr. Amitava Ghosh, Chief Executive Officer, Transcorp International Ltd.

Transcorp cards are highly customizable and, with the approval of RBI, can now be co-branded with a partner organization’s logo; as well as restrict certain merchant categories as per the client’s requirements.

The card reduces risk against fraud as customers can restrict the amount loaded in the card without exposing one’s bank account”. Prepaid Cards are the next significant trend in consumer payments and the market is growing rapidly in India.

” Partners have devised clever business models around prepaid cards and have added new lines of revenue and loyal customers by sharing the benefits of the interchange income that is earned on every spend. By providing digital & physical cards, multiple variants and custom solutions, we are able to get partners live even during these testing times of a global pandemic. There is a tremendous demand for cards & wallets in the financial world and we are evaluating each partnership in detail to meet our strict norms. We are in advanced stages of integrating products like UPI and Fastag with National Payments Corporation of India (NPCI) ” said Mr. Ayan Agarwal, Vice President-Payment Systems, Transcorp International Ltd.

These cards will be available at all Transcorp branches, through select agents and on order. They can be delivered to one’s office or home address even during the lockdown. Those interested in exploring B2B partnerships and wish to discuss business models may contact the Vice President who is heading this business.

Transcorp International Limited is open for business today as it has been for the last 25 years – we are always committed to giving quality services to our customers and partners. Even the present time of lock down the company is operating and providing its following services to its esteemed customers to help the nation and its citizens:

1. Outward Remittances to Indians and families stuck abroad

2. Domestic Money Transfers for migrant workers to send money to relatives

3. Aadhar Enabled Payment Services for families of migrant workers to receive cash

4. Insurance to protect lives and assets during these difficult times

5. Pre-Paid payment solutions for easy access to funds and reduced currency handling

6. Travel services to those who need emergency assistance via subsidiary Ritco Travels